Financial Update 2014 Q2

This will be the first of many financial updates. As I have stated in the past I am not comfortable revealing actual dollar amounts at this point of time, so all of the information presented here will be in the form of percentages.

This will be the first of many financial updates. As I have stated in the past I am not comfortable revealing actual dollar amounts at this point of time, so all of the information presented here will be in the form of percentages.

Emergency Fund: [wppb progress=100 option=green percent=after]

Our 6 months of expenses emergency fund is fully funded, as well as our hills and valley fund to get us through the summer while I am off work.

House Pay Off: [wppb progress=24.5 option=green percent=after]

We originally put down 20% and are contributing an extra $200 every month. After putting 20% into tax advantaged retirement accounts, any extra at the end of the year above our emergency fund will be added to the house balance. Most likely we will wait until the end of the first quarter to make the deposit due to the seasonal nature of my income. We are planning to make our first large deposit in March of 2015.

Goal: Pay off the house in 8 years, by December 2021.

Rental House Payoff: [wppb progress=36 option=green percent=after]

This is calculated off of our original purchase price. We refinanced earlier this year to a 10 year loan and do not plan on putting any extra money towards paying it down early. As stated above any extra savings above the 20% put into retirement accounts will go towards paying off our primary residence. Once our primary residence is paid off by our goal of 8 years from now, then we will start putting extra on this property, but by then it will be a very little amount still owed, about 10% of the loan will be remaining. We owe about a quarter on this property as we do on our primary residence.

To Financial Independence:[wppb progress=3.1 option=green percent=after]

Currently we are 3.1% of the way to F/I. We only started throwing money at this in the past year. Last year we were at under 1%. I am basing our amount for financial independence off of our budget after the house is paid off and kids are grown. We are also basing it off of a 4% withdrawal rate. Most likely we will continue to work for several years after hitting F/I.

Goal: Hit F/I in 18 years at Age 45. This is a very long term goal, It may be achieved much quicker if our income increases. In 8 years when the house is paid off we should be able to contribute a lot more to retirement and hit F/I sooner. 45 is a conservative estimate.

Savings Rate: [wppb progress=23 option=green percent=after]

This includes our 401K, IRA, Roth IRA, Extra house principal only payments and HSA contributions. This also includes our cash balance increase during the measured time. This calculation is from June 30 2013 to June 30 2014. During this time period we had several thousand dollars of unplanned large expenses. Although most years will have large unplanned expenses, this was a bit higher than average. If we were to count the ability to pay for these items in cash, then our savings rate increases to 31%.

Goal: Increase to 30% of gross for the entirety of 2014, hit 33% for 2015.

Action Economics:

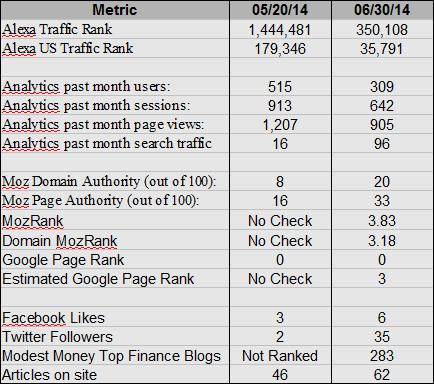

Action Economics is now 9 months old. About 6 weeks ago I started the Yakezie Challenge and made a baseline of tracking statistics. Here is a comparison between then and now.

Alexa Ranking: This has fallen like a rock in the last six weeks, although recently it has slowed a bit. I think going from 350,000 to 200,000 will be more difficult than 1,400,000 to 350,000. I really am not sure how they decide their rankings. I think there is a heavier weight put on search traffic than on referral traffic, otherwise the rapid drop I have experienced really doesn’t match up to my traffic.

Google Analytics: For someone who isn’t too concerned about knocking it out of the park, I do spend a decent amount of time looking over Google Analytics. I love numbers and they provide an insane amount of detail. My stats from May 20th are a bit inflated for two reasons, which explains why the number of users, visits, and page views have decreased. First of all, I received a ton of traffic from Rock Star Finance for sharing my Article The $70 Million Paycheck, a comparison between Floyd Mayweather and a former pro boxer I used to work with, Courtney Burton. This referral accounted for 41% of my traffic for this time period. Myself and a family member were also going through my past articles and editing them for improved grammar, punctuation, and a bit of SEO, this traffic looks to account for about 15% of sessions and close to 30% of page views. Most of that editing is done on the front end now, so there won’t be this discrepancy going forward.

Search Traffic has increased considerably and is on a steady climb. Below is a monthly breakdown. June numbers are heavy on the end of the month side as well, on June 29th I had 11 search visits.

- March: 2

- April: 9

- May: 40

- June: 96

Moz Rankings: I check these stats using check-domains.com. Both the DA and PA numbers have doubled, so that is good, I still have a long way to go! I do not have a google page rank assigned yet, since they apparently are very infrequent with their updates. According to check-domains, I should have a PR of 3. They estimate this using some sort of method that I don’t know or understand, so I don’t really give much weight to this, but I thought I would include it in the stats.

Social Media: I am by FAR not a social media expert, in my real life I have been on Facebook since 2007 and still have under 100 friends (but they are the ones who count!). My facebook likes have doubled, and I think I have been doing OK on twitter and am steadily increasing my twitter followers. How about this, if you are reading this right now and enjoy my articles, consider clicking the two buttons on the right hand side bar to like us on Facebook and to follow us on Twitter!

Articles on Site: I try to put a lot of thought and effort into my articles and I hope that it comes through in them. The past 6 weeks, and really, since March, I have been working in over drive on the site. The article count is on a steady uptick of 8 – 13 articles a month and I plan to stay in that range for some time to come. I proved to myself that while working on the road for a crazy busy season of 12 hour shifts with very few days off I could keep up this schedule, so I can’t see dropping off in the near future.

Money: This is still a young site, and has not started earning any real money yet. There are some sites that in their first year start making some serious money, but I am not on that path right now. I’m not too concerned about it, making money was not an original goal for Action Economics, although as I have been reading more blogs and reading what some other sites are making, I am certainly not opposed to making some money for something I was already going to do! According to Google, I have made around $14 from adsense since incorporating it into the site. Action Economics has not made any affiliate income as of yet.

The framework is in place and I have been working on educating myself on “blog monetization” to get some of that internet money. With time and traffic some money will come. I view this in a similar way to building up a nest egg. In the early months and years the income generated is trivial, the gains come years down the road AFTER putting in a substantial base of hard work.

Leave a Reply