End Of Year Tax Planning

Many of us wait until the last minute on April 15th to file our income tax returns. It’s an overly complex process, it’s unpleasant, and reminds us just how much of our money we give to the government every year. In our last minute haste it is easy to miss some rather significant tax breaks that we can receive with a little bit of planning and forethought. This is also a good time to look over what tax breaks exist to develop a plan to minimize taxation for next year.

Many of us wait until the last minute on April 15th to file our income tax returns. It’s an overly complex process, it’s unpleasant, and reminds us just how much of our money we give to the government every year. In our last minute haste it is easy to miss some rather significant tax breaks that we can receive with a little bit of planning and forethought. This is also a good time to look over what tax breaks exist to develop a plan to minimize taxation for next year.

Tax deductions reduce how much of your money is taxed, so a $2,000 deduction reduces income tax owed by $2000 X tax rate. For someone in the 15% tax bracket, a $2,000 deduction is worth $300. A credit is a reduction in taxes owed. This reduces the total tax burden dollar for dollar, so a $2,000 credit is worth $2,000. There are three different types of tax credits, refundable, non refundable, and partially refundable. A refundable tax credit means that if no income tax is owed, you will receive a check from the treasury for the credit amount. A non refundable credit means that the credit can reduce taxes owed to $0, but will not issue a refund. A partially refundable credit will allow only a portion of the credit to be refunded.

Tax Credits for 2013:

Earned Income Tax Credit: The earned income tax credit is a refundable tax credit, designed to assist lower income families. The credit increases rapidly with earnings up to a point and then levels off for several thousand dollars, then tapers off gradually. For a single mother of 2 the maximum credit is for $5,372, and is achieved with earnings between $13,450 and $17,450. The maximum credit is for having 3 qualifying children resulting in a credit of $6,022 in a certain income range. Use the calculator below to see where you may land. This credit may help determine who should claim a child when more than one individual is eligible to claim a child per IRS guidelines.

Child Tax Credit: The Child Tax credit is available to be used for up to 3 children in a year at $1,000 each. The credit is non-refundable, however it is paired with the Additional Child Tax Credit, that in many situations will allow a refundable credit. This credit is also subject to income limitations, but is much less stringent than the earned income credit.

http://www.irs.gov/uac/Ten-Facts-about-the-Child-Tax-Credit

The American Opportunity tax credit can be claimed for 4 years, per student for a maximum of $2,500 per year. The first $2,000 of eligible expenses receives a $1 for $1 tax credit. The next $2,000 receives a 25 cent for $1 tax credit. 40% of this credit is refundable, so even if no tax liability is owed, the credit holds an advantage. There are income limits on this credit. This tax credit alone, used for 2 years of full time study at Lake Michigan College covers 62% of the cost. If they spread 60 credits out over 3 years at 20 credits a year, it would cover 82% of the cost, with 1 year of credit remaining. This means each year the student would only have to pay a net of $500 per year, for 3 years. This strategy works best for a student who is only planning on earning a 2 year degree, for those planning on earning a four year degree it makes sense to get the full credit each year, by attending full time, incurring total costs of $4,000 for 4 years to maximize the credit.

http://www.irs.gov/uac/American-Opportunity-Tax-Credit

The Lifetime Learning tax credit provides a 20% tax credit for up to $10,000 in expenses. This is per tax filer, not student so parents with multiple school aged children are still limited to a total of $2,000 from this credit. NOTE: Only one of these credits American Opportunity or Lifetime learning can be claimed at once)

Retirement Savers Tax Credit: This is my favorite tax credit. It is worth up to $1,000 per person, so $2,000 for a married couple. Depending on income level a credit for retirement contributions up to $2,000 each is given, depending on income level between 0% and 50% of this contribution earns a credit. For 2013 to take this credit adjusted gross income for married filing jointly must be under $59,000, head of household under $44,250, and single under $29,500. Since contributions to 401K plans and traditional IRA plans are tax deductible if your AGI is close to these limits, an extra contribution can certainly put you into the range for this credit. This tax credit is non-refundable, so it will only reduce income tax owed, and will not generate a refund.

http://www.irs.gov/pub/irs-pdf/f8880.pdf

Tax Deductions for 2015:

IRA Deduction: Individuals can contribute up to $5500 per year in 2013 to an IRA (income limits apply) This limit is for both Roth and traditional accounts.

HSA Deduction: Individual plans can defer from taxation up to $3,350, while family plans can defer up to $6,650.

While there are several other deductions and credits available, these are the ones that we have the most control over without things getting too complicated. One more strategy I would like to suggest is deduction grouping to tax itemized deductions instead of the standard deduction. It makes sense to itemize deductions if you have more itemized deductions than what the standard deduction is. Higher income people tend to itemize more often because they have more expensive houses and therefore pay more in property taxes and interest, and also pay more in state income tax. For someone who is close to the standard deduction with his or her itemized deductions, deductions can be grouped into a single year by doing things like paying property taxes early. This strategy can give every other year enough deductions to itemize, earning a slightly bigger total refund.

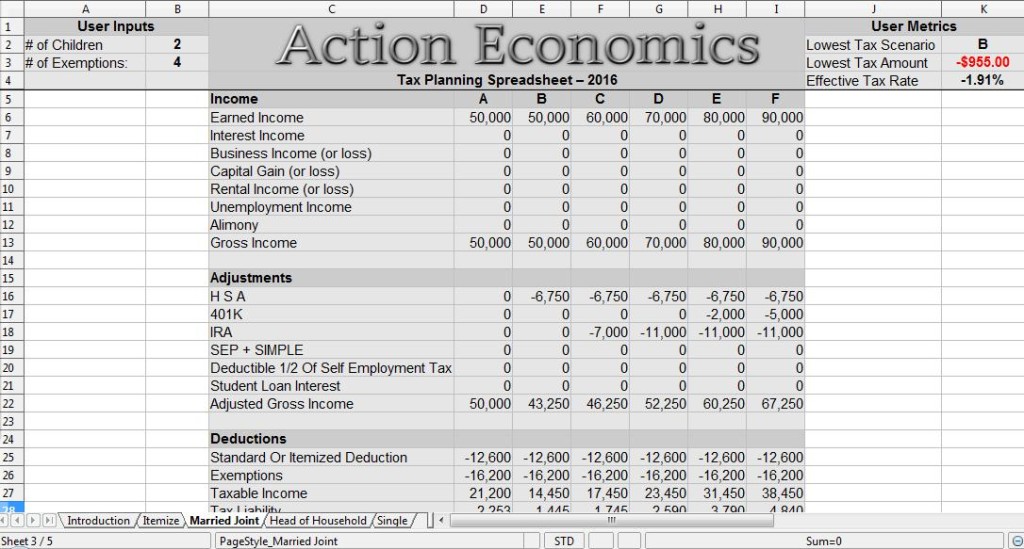

Do your own research and run the numbers, figure out the best strategies for yourself. Unfortunately with our overly complicated tax system it is easy to overpay, and we must work at it to ensure that the government isn’t getting more than “its fair share”. This is why I created the Tax Planning Spreadsheet. This spreadsheet allows the user to run 6 different scenarios side by side, and will calculate out the retirement savers tax credit, child tax credit, and additional child tax credit.

What are you doing to maximize your tax return this year?

Leave a Reply