Checklist For First Time Home Buyers

Buying a home is a major life step and is the cornerstone of the American Dream. Our society puts such a large emphasize on home ownership that we provide incentives to buy homes that in reality can set people up for the American dream to turn into an American Nightmare. Through the FHA people can buy houses with only 3.5% down, some people may even be able to get a 0% down payment. Incentives like these make people believe that they are ready to be homeowners when they are not. Often times these low down payment loans also may include higher private mortgage insurance, higher closing costs, and higher interest rates. Just because a bank is willing to loan you the money to buy a house doesn’t mean that you should buy one yet.

Buying a home is a major life step and is the cornerstone of the American Dream. Our society puts such a large emphasize on home ownership that we provide incentives to buy homes that in reality can set people up for the American dream to turn into an American Nightmare. Through the FHA people can buy houses with only 3.5% down, some people may even be able to get a 0% down payment. Incentives like these make people believe that they are ready to be homeowners when they are not. Often times these low down payment loans also may include higher private mortgage insurance, higher closing costs, and higher interest rates. Just because a bank is willing to loan you the money to buy a house doesn’t mean that you should buy one yet.

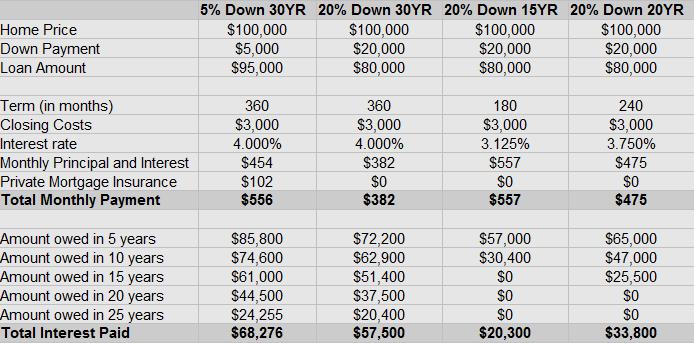

As an example, here is a comparison chart of 4 different ways to obtain a loan for a $100,000 home.

One of the most important details to me is what is the equity in the home 5 years out? The typical American family moves every 5-7 years, so knowing what you will still owe on that house in case you do need to move in this time frame is important. 30 year amortizations provide for a relatively small amount of money put on the principal during the first 5 years. This can be dangerous when paired with a small or non-existent down payment.

When selling a home, the seller typically has closing costs of 3-5%, plus Realtor fees of 7%, at a minimum. In order to cover roughly 11% of the value of the home, there has to be significant equity or you could be stuck. Paying a large down payment and getting a shorter term ensure that you will not be upside down when you need to sell the home.

In the above chart, putting 5% down and getting a 30 year mortgage results in still owing $85,000 on the home in 5 years. After paying 11% in closing costs, this only leaves about $4,000, assuming the house sells for $100,000, but that is no guarantee. What’s really interesting is due to a lower loan amount, a reduced interest rate, and no PMI, the payment on a 15 year with a 20% down payment results in the same monthly mortgage payment. 5 years into the 15 year mortgage only $57,000 is owed, even if the market dropped 30% you could still sell the home and walk away with cash in your pocket!

The monthly payments on a 20 year mortgage are substantially less than a 15 year and it builds equity much faster than a 30 year. A 20 year mortgage is a far better option than a 30 year.

This chart demonstrates why putting down 20% and getting a shorter mortgage term are highly beneficial, build wealth quicker, AND greatly reduce your financial risk. It is also important to look at several lenders to see where you can get the best deal, since closing costs and interest rates vary widely.

The Checklist For First Time Home Buyers

Lifestyle Prepared:

- Plan on staying in the home for at least 5 years

- Know some basic home maintenance skills

- Stable, long term employment

- Stable relationship with anyone who is buying the home with you

Financially Prepared:

- Steady income for 3 years

- No debts in collections (Check out your Free Credit Report from Quizzle

)

- No current debt payments (car payments, credit card payments, etc.)

- 6 months of base expenses cash emergency fund

- 20% Down payment

- Can get pre-approved by a lender

General Guidelines For Monetary Ratios:

- 15 year or 20 year mortgage with a payment less than 1 weeks take home pay.

- Ability to afford the home based on a 35% after tax metric on your own if your spouse/partner were to leave.

Additional Tips:

Do not underestimate the value of a home inspection and septic inspection. These are relatively inexpensive and worth every penny. Never put in an offer without checking the boxes for requiring every inspection available. (Home inspection, Septic Inspection, Well inspection, etc.)

Frequent Questions and comments on purchasing a home:

Why not get a long term mortgage and invest the difference in the monthly payment?

Some will argue that you should put the least amount of money down possible, get the longest term possible and invest the difference. To me, this argument only works for those in a high income bracket and live in a state with high income taxes. For most of us, the home mortgage interest deduction does little to no good, so unless you are in the top 10% of earners, chances are you shouldn’t base your home purchase around the deduction.

Let’s say that someone sticks to the guidelines I put forth here and is able and ready to buy a $100,000 home. By putting down a 20% down payment and getting a 15 year mortgage, his payment is $557 a month. Adding in $50 a month for home owners insurance and $100 a month for property taxes, brings his monthly total to $707 a month. By keeping this number equal to 1 weeks take home pay, his yearly take home pay needs to be $36,707. Although taxes vary substantially from situation to situation, Let’s assume his gross income is approximately $45,000 a year. With a $45,000 gross per year he should be saving 20% for retirement, or $9,000 a year, which works out to $750 a month. The difference in payment between a 15 year loan and a 30 year loan with 20% down is $175 a month, under a quarter of what he is already investing. This is why it is worth being conservative and going with a 15 year loan instead of a 30 year loan. For people who are saving absolutely nothing for retirement, then they should get a cheaper house, not a longer loan.

But saving up $20,000 is impossible!

Saving up a down payment is extremely difficult, most likely, it will be the largest chunk of cash you save in your lifetime. It’s difficult because it needs to be difficult. Buying a house should not be something taken lightly, and it should take several months, and probably a couple years to save up a down payment. If you can not in your budget save for a down payment, then you are not ready to be a home owner. As a home owner emergencies happen much more frequently that require several hundred, and sometimes several thousands of dollars. Having the disciple to routinely save money is a skill every home owner needs to have. If you must buy a house without a 20% down payment, at least buy one that is well below your lending guidelines.

Also, nothing says you have to buy a $100,000 home. Mrs. C. and I’s first home was half that amount, saving up the down payment took us a little over a year and included me working two jobs for a while.

I need to move now because rent is just throwing money away and interest rates are low:

I strongly disagree that rent is just throwing money away. True you are not building any equity, but if you buy a house with little down and a 30 year term, you aren’t building any real equity for several years anyways. At least when renting you are protected from variations in the market price of real estate and if you need to leave, you can, you don’t have to try to sell the house. If the furnace breaks, if the roof leaks, those expenses are covered by the landlord, not you.

As far as low interest rates go, yes, interest rates have been low for several years, and although the FED is working on winding down its balance sheet, which eventually will cause rates to rise, they will not rise so quickly that it will be devastating to get a mortgage. It would be highly unlikely that rates would increase 1% per year, but even is rates almost doubled, it would only add a little over $100 a month to the payment on a $80,000 loan on a 15 year mortgage.

- 3.125% $557/month

- 4% $592/mo (last time rates were at 4% was April 2011)

- 5% $632/mo (Last time rates were 5% was December 2008)

- 6% $675/mo (Last time rates were 6% was August 2008)

- 7% $719/mo (Last time rates were 7% was December 2000)

Even if rates do increase over the next couple years, saving up a 20% down payment and getting a shorter term mortgage will still put you in a better position than having a lower interest rate today with a low down payment and long mortgage.

I’m going to help with the down payment, but the house will only be in my boyfriend’s name because he has better credit than me:

Red flag: To begin with buying a home with someone you aren’t married to is a risky endeavor. You need to be prepared to lose everything invested AND prepared to handle the costs of the home by yourself if the relationship ends. This is especially true if finances and incomes are not equal. This should be very good reason to be more conservative on how expensive of a first home to purchase and how to purchase it. If you are putting anything into the down payment or closing costs, even if your name will not be on the loan, make sure that your name is put on the title.

I came across someone willing to sell me a home on Land Contract, is this a good idea?

Run. Don’t walk, run. Land contracts can work out great for a seller, RARELY do they work out great for a buyer. Typically the seller will require you to put down a decent down payment and they will finance it for you. Most land contracts also carry a higher interest rate than what you would get from a bank. Like any loan with a bank, the lender gets to keep your money and the house if you are evicted for non-payment. Since you can’t qualify for a bank loan, chances are your finances are not in order. If your finances are not in order it makes it significantly more likely that you will default on the loan. I have heard of people selling the same house on land contract and collecting a 10% down payment over a half dozen times. If a bank won’t give you financing, this is a really good signal that you are not ready to buy a house, don’t screw yourself over by getting involved in a land contract deal.

My Lender/Realtor told me I should look at a more expensive house and that I can afford twice the house you are recommending:

You know what your Realtor and Lender have in common? They make money based on how large of a loan you get. The Realtor wants you to buy as expensive of a house as possible. The Lender wants to you buy as expensive of a house as possible with the lowest down payment. Lenders will try to steer you towards longer loan terms and lower down payments. Know your budget before talking to these people. Regardless of what a bank is willing to lend you, stick to your guns, the budget you give yourself is more important than the budget the bank gives you.

Lenders will allow up to a 43% debt payments to GROSS income ratio, which means if someone earns $50K a year, they can have debt payments of $21,500 a year! That is insane, don’t put yourself in that position!

This may seem like a lot of hurdles to go through. But it ensures you will never be house poor. I have friends and family members who have lost their homes and it is an extremely difficult thing to go through. The purchase of a home will be the largest expense you ever undertake, it pays to ensure you understand the numbers and set yourself up for success.

Leave a Reply