Changing The 401K Tax Deduction

The number one rule of economics is that people respond to incentives. Incentives are set up by individuals, businesses, and governments to get people to do something. When it comes to saving for retirement, our government provides some strong incentives to get people to save more. One of the chief problems with the current system of tax incentives is that it gives substantially more value to higher income citizens than it does to lower income citizens through the IRA and 401K tax deduction.

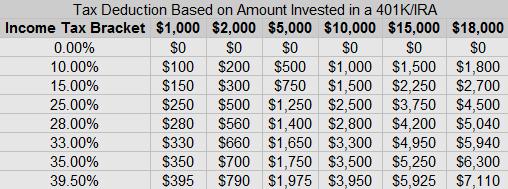

The major tax incentive provided by the federal government is a tax deduction for retirement savings through an IRA, 401K or other similar plan. While I am not a big fan of social engineering through the tax code, I think that it would be better for society to have the tax incentives be more equalized across the board. For high earners, there is a much stronger incentive to save for retirement than there is for lower and moderate earners.The chart below shows at various savings levels what the tax advantage is for individuals across the tax rates. A study in 2013 by The Center on Budget and Policy Priorities shows that a full 66% of tax incentives go to the top 20% of earners, while only 2% go to the bottom 20% of earners. The current system does very little to encourage lower income earners, those who need to save the most, to increase savings, but does a lot to help higher earners shift income and savings into tax protected vehicles. This is very similar to the problem with the mortgage interest deduction, which does very little help more people afford to buy houses.

Lower income earners are less likely to have a job offering a 401K, which means they are capped at $5,500 in retirement savings through an IRA. Lower income earners are less likely to have free cash flow to save. The higher your income is, the more total dollars are discretionary. Think about this, someone earning $180,000 a year in the 28% tax bracket has an incentive of $5,040 to save 10% of his pay, while someone earning $30,000 in the 15% tax bracket has an incentive of $450 to save 10% of his pay. Higher earners have a substantially larger ability to save a greater percentage and total dollar amount for retirement AND receive much larger tax incentives to save for retirement than lower earners.

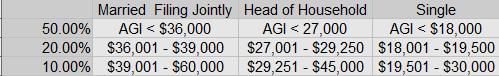

One tool that does some good to help lower income earners save for retirement is the retirement savers tax credit. The retirement savers tax credit costs around $1 billion per year, compared to the $116 billion spent on other retirement tax incentives. This incentive provides a tax credit, on a sliding scale from 10% to 50% of retirement contributions, up to $2,000 per individual based on income. One way to increase retirement savings on the lower end would be to expand this credit. Here are the current brackets for the tax credit:

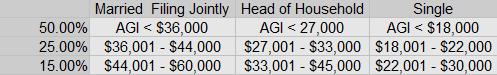

My recommendations on expanding this tax credit:

- Increase the maximum contribution amount from $2,000 a year to $5,500 a year, the maximum contribution for an IRA.

- Increase the middle bracket to 25% and double the range.

- Increase the top bracket to 15%.

- Make the tax credit up to 50% refundable.

The results would look like this:

Of course this would increase the cost of the program, so it would need to be paid for somehow. I’m strongly against unfunded tax breaks, so we need a way to fund this expanded credit. From my point of view, reducing the rate of the 401K and IRA tax deduction would be the best way to go about this. Limit the 401K deduction for those above the 25% bracket to a maximum of a 25% tax deduction. The same amount of income could still be deducted, so for someone in the 33% tax bracket, they would reduce their tax rate from 33% to 8%, instead of to 0%.

Isn’t this playing Robin hood? take from the rich and give to the poor?

In a way the concept of a graduated income tax is set up to take not just more total dollars, but a higher percentage of money from higher earners. In an ideal world we could get rid of the graduated income tax and have a flat income tax, or a consumption tax to completely replace the income tax. Since these solutions are politically unviable and extremely unlikely to occur, we are working on details within the system that already exist. Changing tax deductions and credits from favoring higher earners to favoring lower earners doesn’t “take” more money from the high earners and give to the lower earners, it only adjusts the incentives.

If we really want to encourage lower income workers to save for retirement:

1. Make Actionable microeconomics a required class in all high schools. As part of the curriculum students will set up a bank account, set up an IRA and a Roth IRA linked to the bank account, and make projections for retirement income based on a variety of contributions rates and different age start times. Just by having the administration and an account already set up that they know how to use and access will help greatly once they start working, even if no 401K is offered through work.

2. Business owners should change their 401K plans to auto-enroll. Many already have this set up. Auto-enrollment with the maximum contribution set up to get the full match makes a major change in enrollment rates.

What do you think of my plan to change the tax deductions for higher earners and increase the retirement savers tax credit? Do you think it would get more people in lower income brackets to save for retirement? What other ideas to you have to help encourage people to save for retirement?

Leave a Reply